From 2023 to 2024, supplier costs increased by approximately 10% across the board. While there is an anticipation that from 2024 to 2025 there will be much slower supplier cost increases as inflationary pressures reduce, we expect continued significant increases in the National Minimum Wage and potentially in business rates, which will ensure overall operational cost pressures remain. Therefore, we would suggest that most hospitality and leisure businesses will likely wish to continue to increase their revenues by 10% to protect their margins.

While price increases may be expected, businesses need to manage these carefully to ensure customers still feel they’re getting value for money and price-sensitive visitors don’t leave for a competitor.

Raising prices strategically

When forecasting pricing for evergreen sale items and package deals, it is important to consider the following:

Strategic Pricing – It’s advisable to strategically price on the higher side initially. This is particularly relevant when selling a package of flexible products, as there is then room to adjust during negotiations.

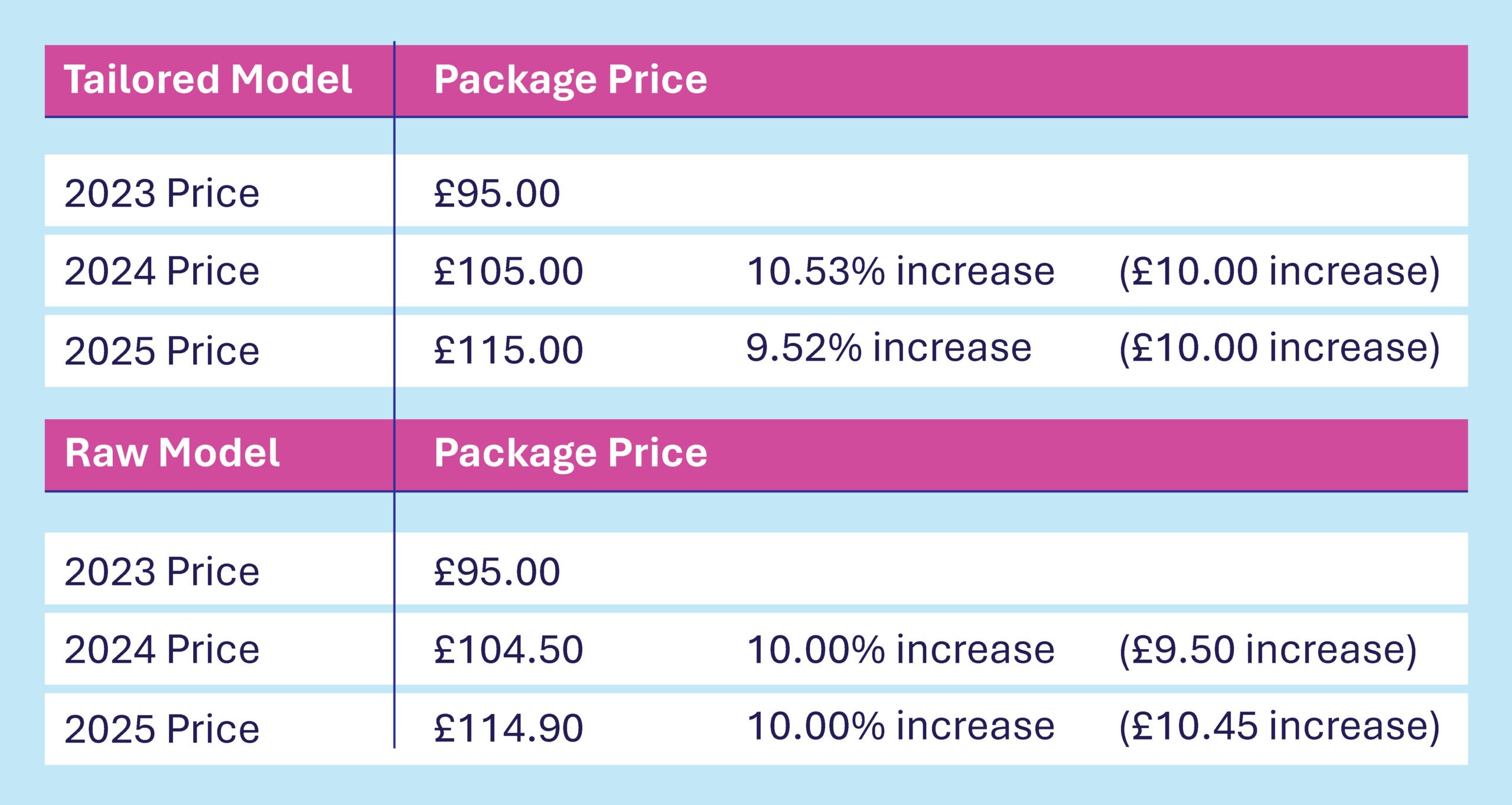

Tailored Pricing – Instead of a raw percentage increase, consider tailoring prices to maintain a logical pattern, making it easier for customers to digest. For example:

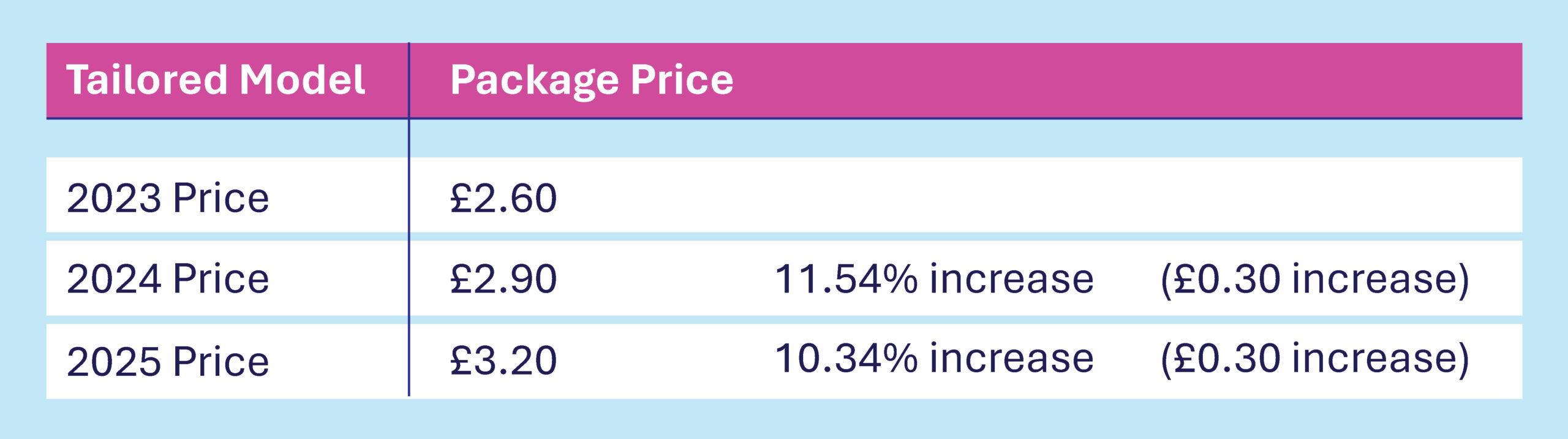

Small Value Items

For items with lower values (e.g., coffee), a slightly higher than the percentage increase can be applied while still maintaining a pattern.

Keeping customers happy when raising prices

There are several key factors to consider in how price rises will be perceived by your customer base and how they will impact your bottom line.

- Customer Perception – Customers may not notice larger percentage increases on higher-priced items compared to smaller, regularly purchased items. Using the above model as an example – consumers are more likely to notice a 30p increase on a cup of coffee than they would notice £10 on a £100+ per head corporate package deal.

- Inflation Impact – Adjustments should be proportionate to inflation rates; larger hikes may be acceptable during periods of significant inflation.

- Blended Profit Margin – Focus on maintaining an overall blended profit margin rather than fixating on individual item profit margins.

- Customer Value Perception – Customers tend to notice price shifts more on items regularly purchased, so consider holding prices on such items. With items that are purchased more commonly, there is an implied ‘pre-set value’ in a customer’s mind, and this translates to a more sensitive perception of these increases.

Ensure flexibility in your approach

When offering items such as package deals which carry a degree of flexibility, ensure that sales personnel are briefed on a ‘floor’ level for negotiations, ensuring they have the flexibility for discounts while still meeting desired profit margins.

Effective stock management is key to understanding impact

Consider implementing a comprehensive integrated stock system for effective management of Theoretical GP Margin % on all items.

The most efficient systems are capable of integrating with EPoS systems, providing real-time reporting and stock appraisal, and most will have the benefit of dynamic reporting tools that can be used to forecast and plan demand, highlight sales trends, stock turnover rates, and overall inventory performance.

A comprehensive system may also integrate with accounting systems, providing a seamless flow of financial information related to inventory, such as cost of goods and overall profitability.

With price pressures showing no sign of easing, businesses will continue to need to walk the difficult tightrope of managing margins and keeping customers happy. With a strategic approach and an eye firmly on customer perception, they can find the perfect balance.

If you’re having trouble balancing rising costs and customers with less cash to go around, reach out and speak to our experts about how to build a pricing model that keeps everyone happy.

" />

" />

Instagram

Instagram Facebook

Facebook Linkedin

Linkedin